How to rethink the 'capital' in stakeholder capitalism

15 Jan 2024

• Seismic economic, geopolitical and technological shifts in the global landscape are challenging the modus operandi of companies and CEOs.

• Leaders need to build their businesses around five types of capital to survive the volatile times to thrive in the longer term.

• The five types of capital align with the World Economic Forum’s stakeholder capitalism metrics, as outlined in its Measuring Stakeholder Capitalism white paper.

Some 2,500 years ago, Heraclitus proclaimed: “There is nothing permanent except change.” Reflecting on the unprecedented scale, pace and reach of change mankind has navigated over the past three years alone, it’s fair to say the Greek philosopher’s adage remains as true in the 21st century as it was in 475BC.

Facing seismic disruptions as the tectonic plates of technological advancements, climate crisis, rising inflation and a rapidly changing geopolitical environment have met head-on, industries and organizations must navigate near-constant upheaval in order to maintain a forward, and upward, growth trajectory.

To do so successfully means rethinking the role of a CEO beyond the walls of their company towards becoming a considered voice in a variety of new domains. Today, leaders must forge both resilient organizations that lean into sustained and sustainable business opportunities, as well as becoming valued thought leaders in community stewardship and agents of broader economic prosperity.

While it’s arguable that building successful businesses has always hinged on a leader’s ability to understand and adapt to market conditions, what has shifted is the expectation that those insights remain closeted in boardrooms and business strategy elsewhere, and instead fuel a leader’s ability to become informed advocates for positive change.

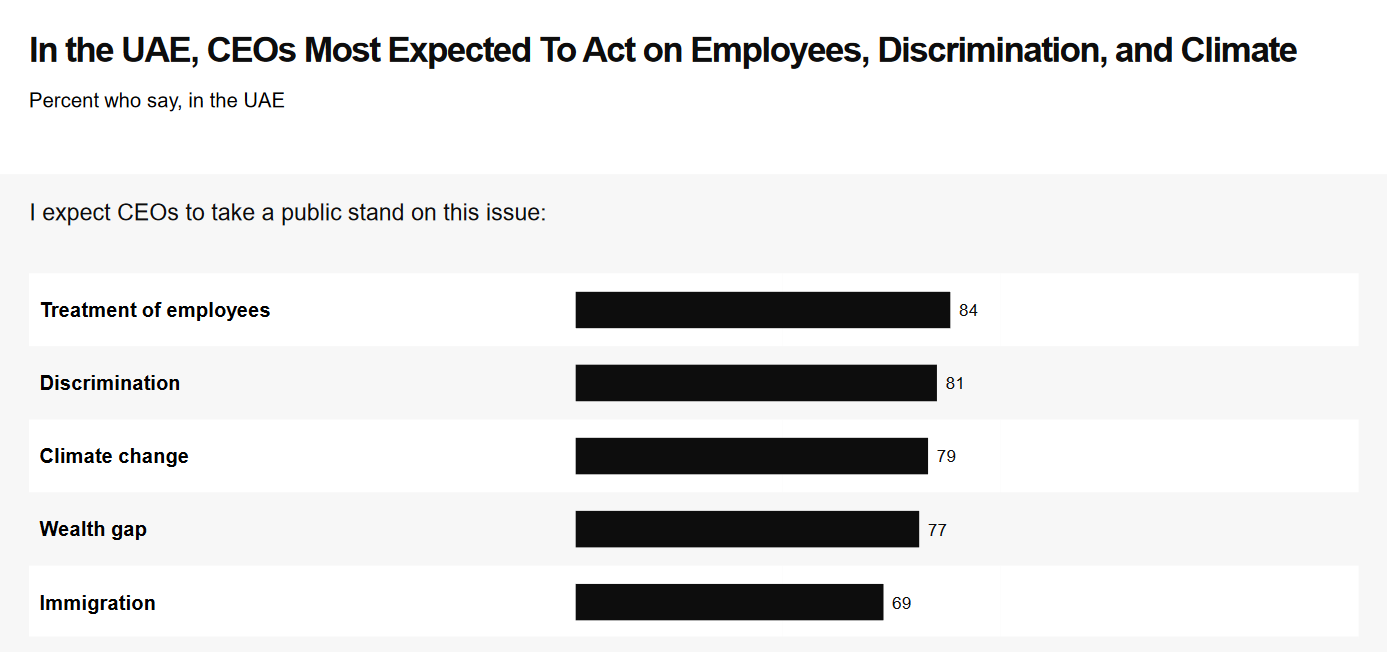

https://assets.weforum.org/editor/mmoELNO7SgQmwRQsATJAfi82o7CNitR92jGsSwNFLiw.png

CEOs increasingly have a social, as well as financial, remit. Image: Edelman Trust Barometer

As the expectation and demands on private sector leaders expand, so does the number of stakeholder groups to consider. In 2020, the World Economic Forum articulated this concept as “stakeholder capitalism”, and in 2021 followed with a set of metrics that enable organizations across the public and private sector to focus their efforts and measure their degrees of success.

Anchoring business in common standards and frameworks is undoubtedly critical to aligning endeavours. But what makes it possible to deliver on these broader demands is the emergence of a new form of organizational wealth: trust.

Trust leaders

Here in the United Arab Emirates (UAE), trust in business, government and other institutions is among the highest in the world. The latest Edelman Trust Barometer finds a total of 78% of respondents reporting trust in businesses and 86% trust in government, compared to an average of 50% and 37% in the UK and 55% and 43% in the US.

This has not happened by chance. It has been achieved by considering a broad spectrum of interests, from economic and educational needs to personal and professional well-being. These are enshrined in “The Principles of the 50” , a set of 10 guidelines for the next 50 years designed to help all institutions in the UAE build a sustainable and more prosperous society.

It is the harmony of business and government making these principles work, and it is why at Majid Al Futtaim, we are reinforcing a holistic approach to business in our own definition of five types of capital.

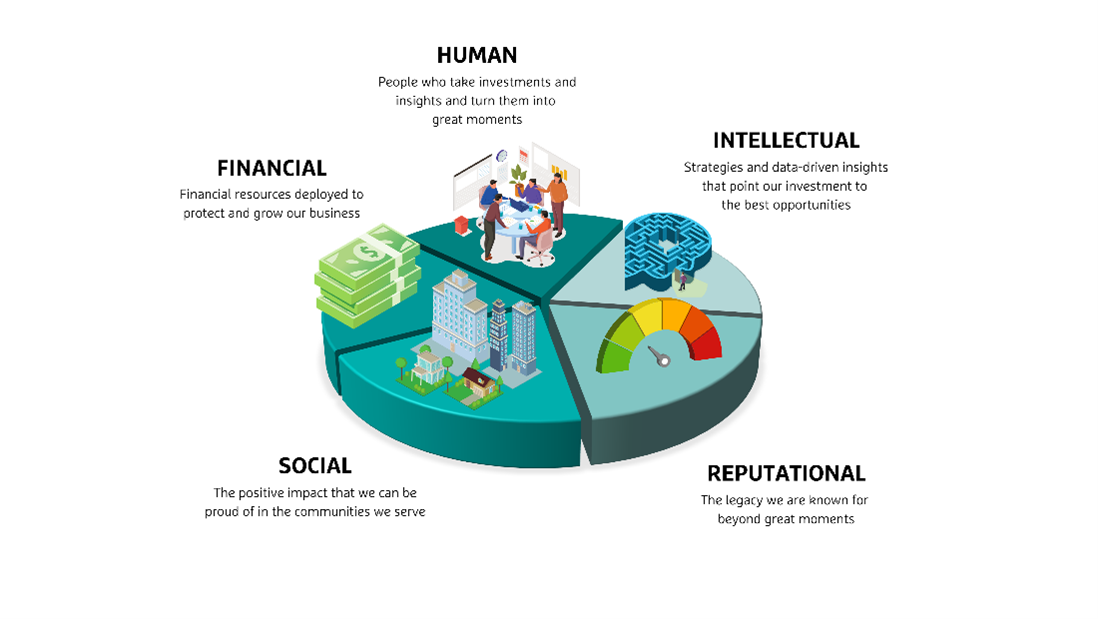

The five types of capital

The five types of capital are a centrepiece of our new strategy. They span all areas of life at our company and in all markets in which we operate, because we know that businesses and business leaders not only need a broad base to build trust upon, but also structure that keeps an even keel when navigating choppy waters.

The five business capitals. Image: Majid Al Futtaim https://assets.weforum.org/editor/FKoYsVapAzs5Qs3QtocZRtGlSWvA7R4KtERIOyJvwKo.png

Just like the Forum’s metrics – which prioritize people, the planet, prosperity and principles of governance as ways to ensure organizations can generate shared and sustainable value – our five types of capital are tailored to serve the needs of different stakeholders and different businesses.

• Financial capital. Historically, maximizing returns on financial capital is the area where most CEOs are traditionally focused and most comfortable. Instead, leaders should focus on using financial resources to seek out sustainable growth for the long term, while ensuring near-term performance never slips down the priority list.

• Intellectual capital. Embracing data-driven insights in this age of rapid technological advancement is the only way to spot the best opportunities and evolve group-led growth. Netflix is a leading light here – the data it has on its users powers a personalization process on accounts that has led to a customer retention rate of 93%, far beyond that of its competitors.

• Human capital. A mindset shift is needed, away from individual journeys and towards collective ones. We are all in this together and need to help each other along the way if we are to prosper. Team-based structures are one approach to achieving this and something that companies around the world have benefited from, including Apple. In addition, directly linking stakeholder well-being with company purpose, values and vision (and regularly pulse-checking the same) ensures leaders foster a culture that aligns with its aspirations. A recent study by Deloitte, The Elevated Talent and Culture Agenda in the Boardroom, highlights the burgeoning understanding culture plays in successful leadership.

• Reputational capital. Success always depends on stakeholder trust in your brand and your ethos. This means companies must treat customers and employees fairly and exhibit competent leadership. Newsweek’s list of the World’s Most Trustworthy Companies for 2023 admirably demonstrates the inherent link between reputational strength and trust.

• Social capital. Reflecting the increasing onus on leaders to act as both business thinkers and community role models, equal attention must be given to the “S” within an organization's ESG agenda.

While the five types of capital are distinct, they are also inextricably interdependent: This mutual support strengthens each aspect, which in turn further strengthens the whole. Across one organization, these frameworks enable cohesion, shared vision and aligned ambitions. Across many, they have the potential to shape our communities and enhance collaboration across industries and sectors.

Heraclitus’s sage reflections on change have proven true over the 25 centuries since they were first uttered, and will no doubt remain true for many more to come. It is my hope that his thoughts on ambition, that is to say “big results require big ambitions” ring equally true.